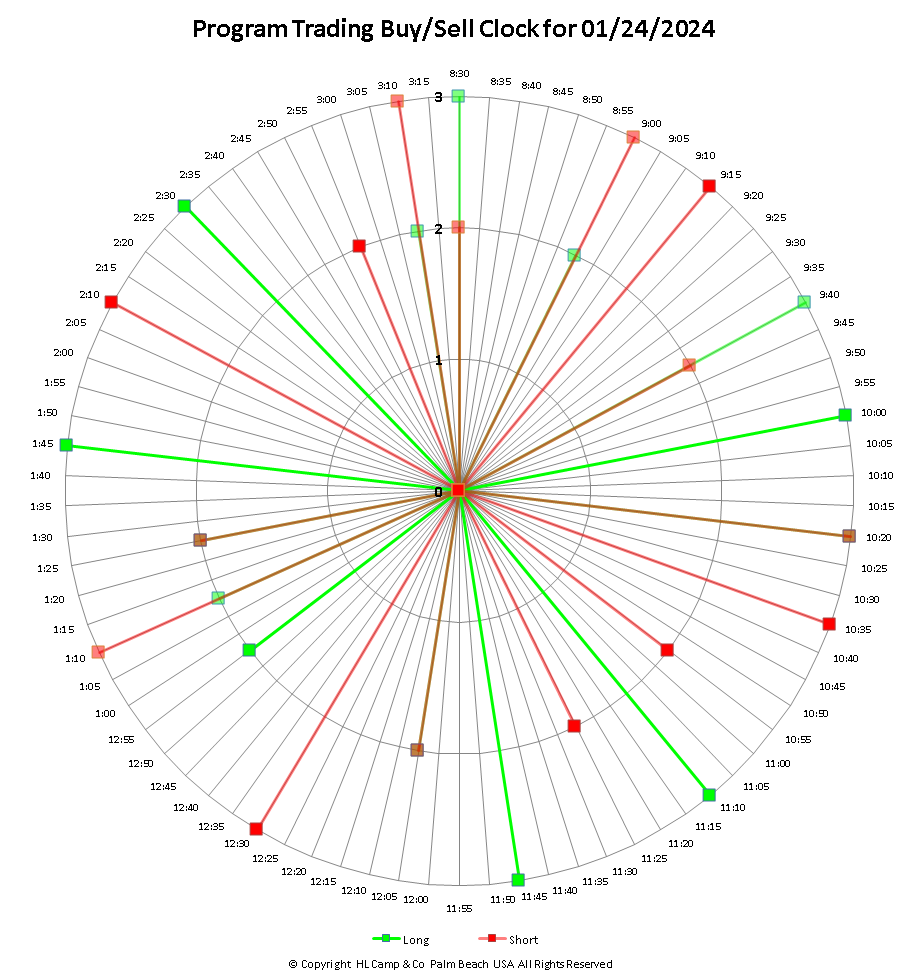

Program Trading Clocks®

Retail customers trade based on price. Most lose money doing it. Program Trading Desks trade based on time. They make money doing it. So it is easy for you and your fund to know which one is the most important. In general, program trading has little to do with price. Something that surprises a lot of traders and retail customers who are constantly talking about and using price for their trading. Statements like support is at such and such and resistance is at another such and such. Market Profile and the Fibonacci number for today is such and such, and the latest craze, today's pivot points are such and such. All of this talk about price is really for amateurs and retail customers who do not have a clue about program trading. And program trading is over 90% of the volume every day, and on some days runs a lot, lot more.

Program Trading Desks trade based on time. And they have our Program Trading Clocks on the wall to tell the time every day. If you would like to see one clock for one day, just scroll down below. Most likely, you have never seek anything like it. So what time is it? Program trading is based on time and that time is Central USA Time. All program traders world wide are on Chicago Time. Where you live or work, just like price, is totally irrelevant.

|

|

|

|

|

|

|

To subscribe to Program Trading Clocks please click here to subscribe.

We will program your user name and password and

email you your log in information immediately. |